Home / All About Silencers / What Happens to Your Suppressor When You’re Gone?

Home / All About Silencers / What Happens to Your Suppressor When You’re Gone?

What Happens to Your Suppressor When You’re Gone?

William Lawson

What happens to your suppressor when you pass away? That’s a legitimate and common question. After all, buying a suppressor requires going through the Form 4 process under the National Firearms Act (NFA). Surely, passing it on will require more hoops, right?

Well, yes and no. It depends on how you bought your suppressor. Don’t worry, the ATF will still be involved, but a little preparation now will ease the process down the road.

Can You Inherit a Suppressor?

Absolutely! The first thing to address is whether the suppressor is owned by an individual or through a trust. Let’s examine those briefly and understand what they mean while the owner is alive and after they are gone. Then we’ll move on to general suppressor ownership information that applies not only to the original owner, but any beneficiary that person may name.

Individual Ownership

The first ownership option is to buy your suppressor as an individual. This option allows only you and people under your direct supervision to handle the suppressor. You must be present and involved even with close family members.

Individual ownership means that anyone to whom you might will your suppressor to must go through the same ATF background checks that you did before taking possession. That person would qualify for a one-time free transfer via NFA Form 5, absolving them from paying for the $200 tax stamp. Your estate’s executor would hold the suppressor until the process is complete. If you choose not to pass your suppressor on, or if the beneficiary doesn’t want it or is ineligible, the executor will surrender it to the ATF.

Ownership Through a Gun Trust

The second ownership option is a gun trust. You can establish the trust yourself, with which companies like Capitol Armory can help you. An attorney can also set up the trust if you prefer. You still go through the Form 4 process and pay for the tax stamp, but the trust owns the suppressor.

You, as the trustee, control the trust and amend it as you choose. The trust’s owner may be called the settlor, grantor, maker, or trustor, depending on the trust. You can add co-trustees, with whom you share control of the trust. The co-trustee must meet all ATF requirements to own a suppressor to qualify as a co-trustee.

Trusts offer several advantages over individual ownership. Your suppressor, and any other items in the trust, would automatically transfer to your co-trustee upon your passing. The co-trustee would then own the trust. No ATF paperwork is needed, including the tax stamp since the tax stamp itself is for the trust. The trusts new owner could then add co-trustees or beneficiaries as they see fit using the same process you did. The co-trustee can also turn the suppressor in to the ATF if they choose.

Understanding Suppressor Ownership and Legalities

Suppressor purchases and ownership are controlled by the National Firearms Act (NFA). That means you can’t just buy one and take it home the same day. The following requirements must be met before you, or your beneficiary, can take possession of it. These requirements also apply to co-trustees before they can be listed as such.

Age Requirements

- Be at least 21 years old to purchase a suppressor from a dealer using an NFA Form 4.

- Be at least 18 years old to purchase a suppressor from an individual through a Form 4-to-Form 4 transfer, subject to state laws.

- Be at least 18 years old to possess a suppressor as a responsible person of a trust or as a member of a corporation, contingent on state laws. This also applies to purchasing on a Form 4 from an individual to a trust or from one individual to another.

Residency

- Be a United States resident.

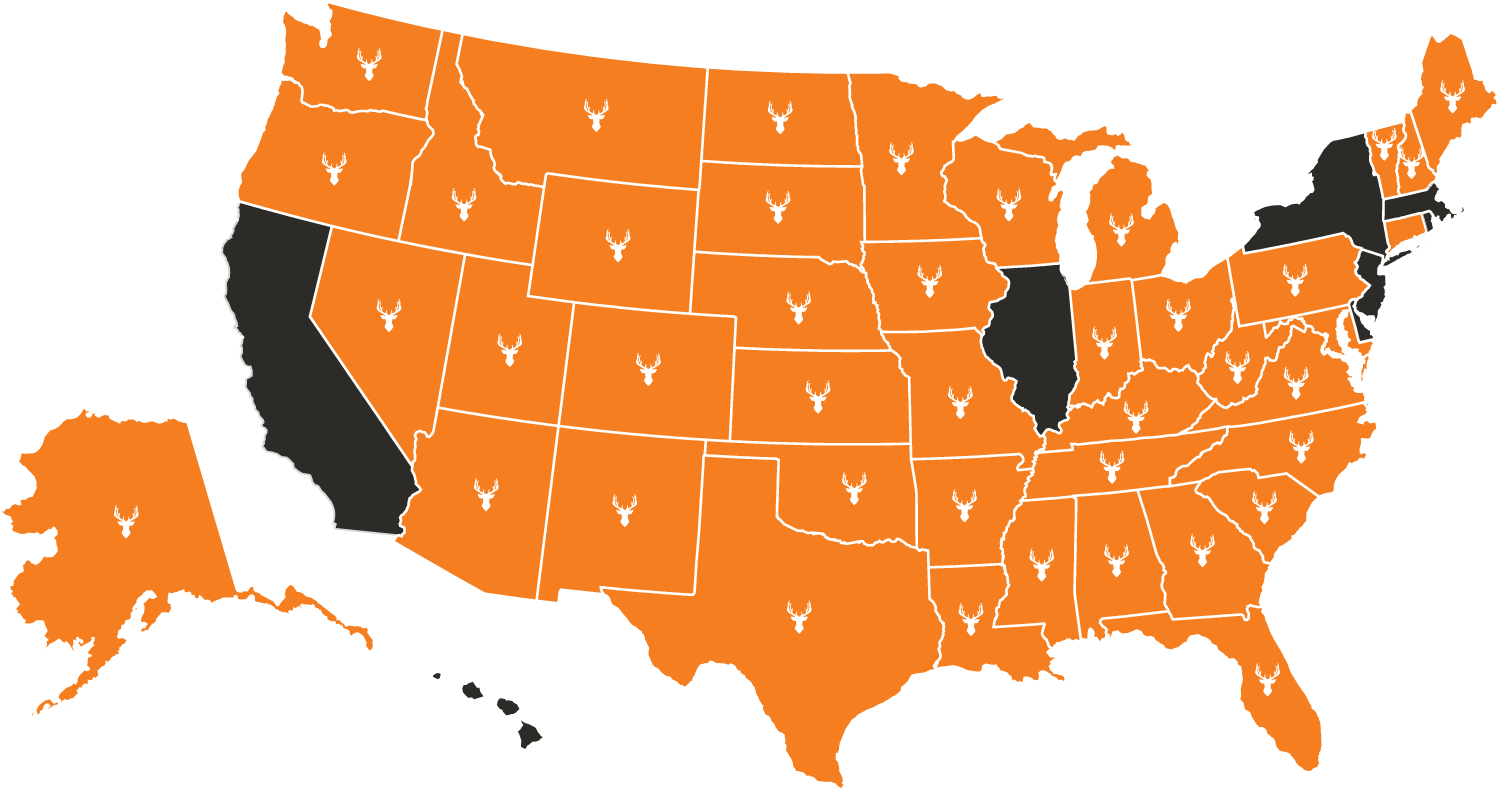

- Reside in one of the 42 states that currently allow civilian suppressor ownership.

Eligibility

- Be legally eligible to purchase a firearm.

- Pass an ATF background check.

Transfer Tax

- Pay a one-time $200 Transfer Tax unless you are a beneficiary filing an NFA Form 5, which allows for a tax-free transfer without the need for a stamp.

Steps for Legally Transferring a Suppressor from a Dealer

- Carefully complete two copies of NFA Form 4 (5320.4). Use blue or black ink. ATF also has e-forms available.

- Obtain two passport photos and affix one photo to each Form 4. Do not staple them. The photos will be uploaded for e-forms.

- Make one photocopy of your completed Form 4 with passport photo affixed. If using e-forms, download a copy for your records.

- Use SilencerCo’s example to carefully complete two copies of FBI Form FD-258. Use blue or black ink. You get the point about e-forms by now.

- Identify your Chief Local Law Enforcement Officer (CLEO). You must submit your paperwork to this individual, declaring your intent to purchase a suppressor. That person will also have the opportunity to present disqualifying material to the ATF.

- Write a check for $200 to the Bureau of Alcohol, Tobacco, Firearms, and Explosives. You may also pay by cash, credit or debit card, or money order, but SilencerCo recommends a check because, when it clears, you will know your forms are being reviewed. SilencerCo also recommends writing your suppressor’s serial number on the check’s memo line.

Gun Trusts in Suppressor Ownership

A gun trust, as we’ve noted, is a legal entity which owns the items registered with it. Those items can include NFA items like suppressors, machine guns, or short-barreled rifles. The trust can also own regular firearms if you like.

You can add co-trustees of your choice after they pass the ATF background check. You can also add a “Responsible Person” who is authorized to handle and use your suppressor without your supervision. Those folks must fill out an NFA Responsible Persons Questionnaire and pass the ATF background check, including fingerprints.

The trust allows you to easily pass along your suppressor to a co-trustee. Depending on the trust, it can also protect your property from other legal action. You’ll need to check with an attorney in your state for those details.

How To Include Suppressors in Your Estate Plan

Trusts do not replace your estate plan. They are part of it. As we’ve said, trusts make it easier to pass on your suppressor or other NFA items. You can amend the trust any time you like to name co-trustees and/or beneficiaries. The trust operates according to your will.

Beneficiaries do not have to be co-trustees. If you want to leave a specific firearm to your minor grandson, for instance, you can specify that in your will. The trust will transfer that firearm to him upon the will’s execution. If you want to leave him a suppressor, the trust will hold it for him until he turns 18 and can legally transfer it or become a co-trustee.

What Happens If You Don’t Plan Ahead?

Not planning ahead means that other people will decide what happens to your property when you die. Each situation is different, but if you did not specify that your grandson gets certain items, he may not get them, especially if he’s a minor. If you own a suppressor as an individual, you won’t have a co-trustee to take charge. The executor may choose to surrender your suppressor should no eligible individual want to take it.

FAQs About Suppressor Ownership and Inheritance

What is the eForm 4 Process?

The process of purchasing a suppressor starts with the ATF Form 4. Traditionally, this was a paper application used to notify the ATF and your local Chief Law Enforcement Officer (CLEO) of your intent to buy a suppressor. Today, you can complete the process online at www.atf.gov. The eForm 4 significantly reduces the time needed for data entry and eliminates the delays associated with mailing documents, leading to much faster approval times.

Are Suppressors Legal in My State?

Suppressor ownership is legal in 42 states. Check the accompanying map to see if your state allows civilian suppressor ownership.

Can I Hunt With My Suppressor?

Whether you can hunt with a suppressor depends on your state’s laws. Of the 42 states where suppressors are legal, 41 allow hunting with them. Connecticut is the only exception. Refer to the map for specific state information.

Can I Travel With My Suppressor?

Traveling with a suppressor is straightforward. If you’re headed to one of the 42 states where suppressors are legal and you own yours legally, you can travel there with your suppressor. However, be cautious when passing through states where suppressors are outlawed, as you cannot transport a suppressor through those states.

While you can choose to file Form 5320.20 with the ATF for travel, it’s not strictly necessary. Form 5320.20 specifically addresses “any destructive device, machine gun, short-barreled shotgun, or short-barreled rifle” and doesn’t specifically mention suppressors.

This article is meant for informational purposes only and should not be construed as legal advice. If you have a question about the law, consult a qualified attorney.

Conclusion: Ensuring the Legal Transfer of Your Suppressor

Owning suppressors requires some extra work, but they are also among the most useful and enjoyable firearm accessories available. A quality suppressor is worth the effort. Firearms are often handed down through generations. Why shouldn’t suppressors be the same?

But, like the initial purchase, passing on your suppressors is different than merely leaving a hunting rifle to a grandchild. We’ve laid out the basic tenets for doing so here, but you have to do the work. We recommend purchasing your suppressors through a trust, but that’s up to you. If you bought a suppressor as an individual, you can still establish a trust if you want. A competent attorney can help you with that.

As with a will, a trust makes it easier for your beneficiaries after you’re gone. Remember that while you may not see the need for a will or trust, things can get dicey for your family without them. You can spare them that with just a little effort.

We encourage you to plan your affairs in advance and make them known to your beneficiaries and co-trustees. That eases the transition and ensures that your stuff goes to the people you designate. It’s better for everyone.