What Is an ATF Tax Stamp?

Kat Ainsworth Stevens

If you’re thinking about buying a suppressor, you’ve probably heard of the ATF tax stamp. You might be wondering exactly what an ATF tax stamp is, why it exists, and how you get one. We’ll answer those questions in this article to help smooth out the process of buying your suppressor.

What is an ATF tax stamp?

The ATF tax stamp serves as a certification confirming the registration of an NFA item and the application of the $200 federal tax. This tax revenue is then deposited into the U.S. Treasury Fund.

Initiated in 1934 alongside the enactment of the National Firearms Act, the tax stamp requirement has persisted through subsequent legislative changes, such as the Gun Control Act of 1968. Currently set at $200, this fee is paid directly to the federal government, not to the manufacturer, and is essential for obtaining a suppressor or any other NFA item.

Why do you have to pay for an ATF tax stamp?

The mandatory fee is an essential requirement dictated by the National Firearms Act and is uniform across all states, regardless of location.

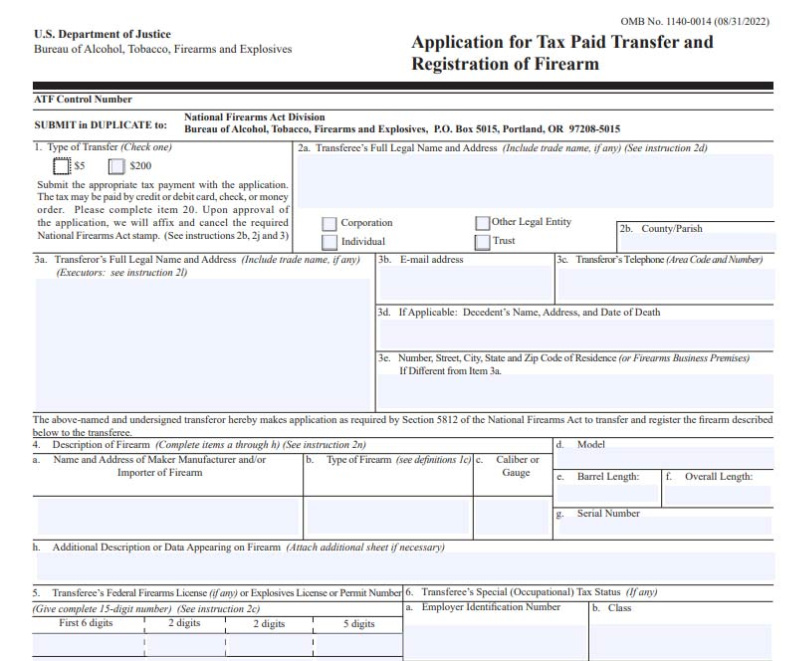

The $200 fee accompanies your application, specifically Form 4, for the suppressor. Essentially, it serves as a tax on the item itself. As per the ATF, all tax stamp fees are directed to the U.S. Treasury Department and contribute to their general funds.

For the fiscal year of 2022 the ATF information shows that $91,462,604.64 was collected for NFA making and transfer tax. In that same year, $9,569,698.25 was collected for NFA special occupation taxes.

How does the tax stamp work?

Once the tax stamp is approved, it’s specifically designated for the particular NFA item you’re purchasing, such as a suppressor.

It’s important to note that each item requires its own individual tax stamp — you cannot utilize one stamp for multiple items. Therefore, if you intend to acquire a short-barreled rifle alongside a suppressor, separate tax stamps are necessary for both the SBR and the suppressor, entailing two distinct tax stamp fees.

The approval timeframe for tax stamps varies, with an average wait period of around 6 months. However, this duration can fluctuate, either shorter or longer.

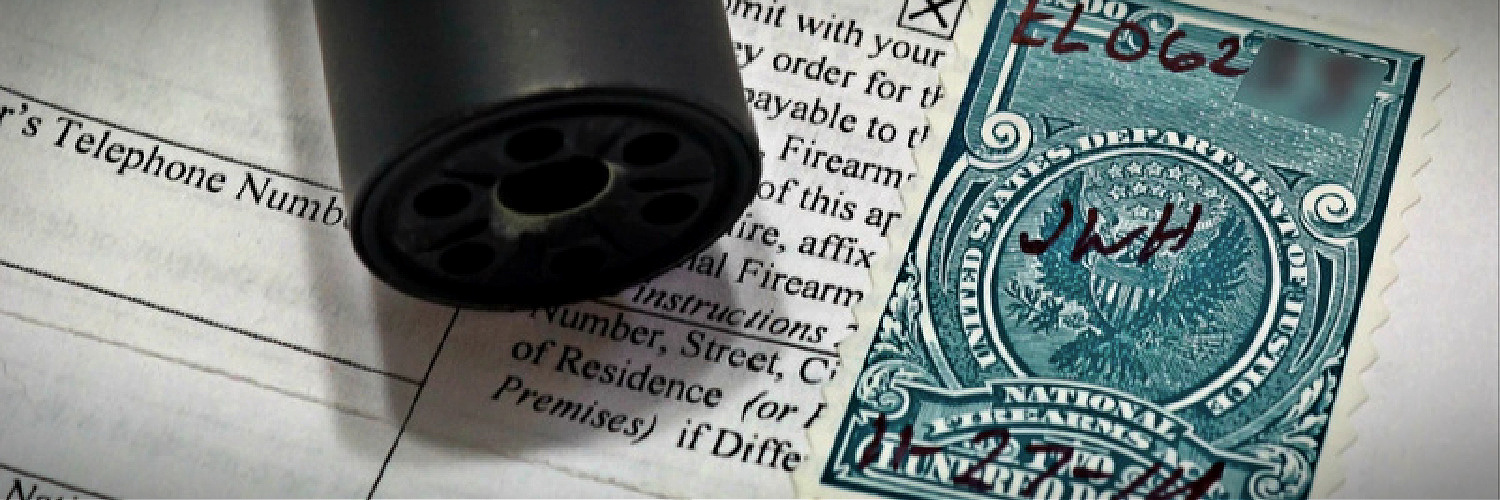

Upon approval of Form 4 by the ATF, the tax stamp — a postage-stamp style item — is affixed to the document by the authorizing ATF agent. Details such as the item’s serial number, approval date, and the agent’s initials are inscribed on the stamp.

How do you get approved for a tax stamp?

Most NFA items require completing a Form 4 and paying the associated tax stamp fee. Approval for a tax stamp requires submitting a fingerprint card and undergoing a background check.

It’s crucial to ensure accuracy and thoroughness when completing all ATF paperwork, as even minor errors can lead to a rejected application, so take your time when doing all ATF paperwork.

Can a tax stamp be transferred?

The process of transferring a tax stamp can vary depending on specific circumstances.

In the event of transferring a tax stamp from one individual to another, the recipient must complete a new Form 4 and pay the transfer tax fee. Once more, while it’s not considered a new stamp, it entails an additional fee.

Do you have to tell the ATF if you move with an NFA item?

When it comes to relocating with an NFA item, there are specific guidelines to follow. If you’re moving with a suppressor, current regulations do not mandate informing the ATF of the relocation. However, if you’re relocating with a different NFA item, such as a short-barreled rifle, you’re obligated to complete ATF Form 5320.20.

NFA Firearms That Require Tax Stamps

Tax stamps are required for all items firearms regulated by the NFA. This includes:

- Full-auto firearms.

- Rifles with barrels under 16 inches in length.

- Shotguns with barrels under 18 inches in length.

- A rifle or shotgun that’s been modified in a way that reduces its overall length to under 26 inches.

- Firearms with a bore diameter of more than one-half inch (over .50 caliber).

- Any Other Weapon (AOW) which the ATF classifies as “weapons or devices capable of being concealed on the person from which a shot can be discharged through the energy of an explosive. AOW includes items such as pen guns and cane guns.

This also means that if you purchase or build a firearm with multiple NFA features, you’ll be paying the tax stamp fee for each of those. For example, a short-barreled rifle with a suppressor will require two tax stamps, not one.

Has the ATF tax stamp fee changed?

No, the tax stamp fee remains unchanged. Initially set at $200, this fee was commensurate with the cost of items like full-auto firearms.

While the prices of such items have significantly risen over time, the tax stamp fee has remained constant. If the ATF were to change it, it would likely increase to thousands of dollars based on the increase of the related NFA items.

Yes, it's worth it!

It’s a great idea to get a suppressor for hearing protection — among other reasons — and that means getting a tax stamp. While it does entail some waiting time and financial investment, the eventual payoff is well worth it.

Whether you’re a hunter or a sport shooter, a suppressor is a great investment.